Poor mental health has been revealed as one of the biggest causes of debt, according to the Mental Health Foundation.

But that doesn't mean you have to let it dictate how you live your life. If your mental health is suffering or you know someone that is struggling with theirs, speak to somebody and seek professional help through organisations like Mind – don't suffer in silence.

At Cabot, we are here to listen and, in turn, teach you how to manage debt problems and get you on the road to financial recovery. Below, we provide some information and tips to help you if you are feeling overwhelmed with debt.

What is problem debt?

According to Citizens Information, any form of credit is a debt, so most people have some debts. It is only when you are unable to keep up with the payments that your debt becomes a problem.

Taking steps towards debt recovery

A survey by the Money and Mental Health Policy Institute (MMHPI) in 2016 found correlations between debt and mental health. The study showed that one in four British adults with a mental health problem also had problem debt. If you feel you are struggling due to mental health and debt, please contact one of our support staff, who will be happy and willing to help. Our aim is to get you on the path that works best for you.

Create order

Once you have realised what may be affecting your mental health – such as irregular payment schedules from different banks or creditors – you can create order. Mental health charity Mind offers tips, like choosing a regular time each week to look at your finances.

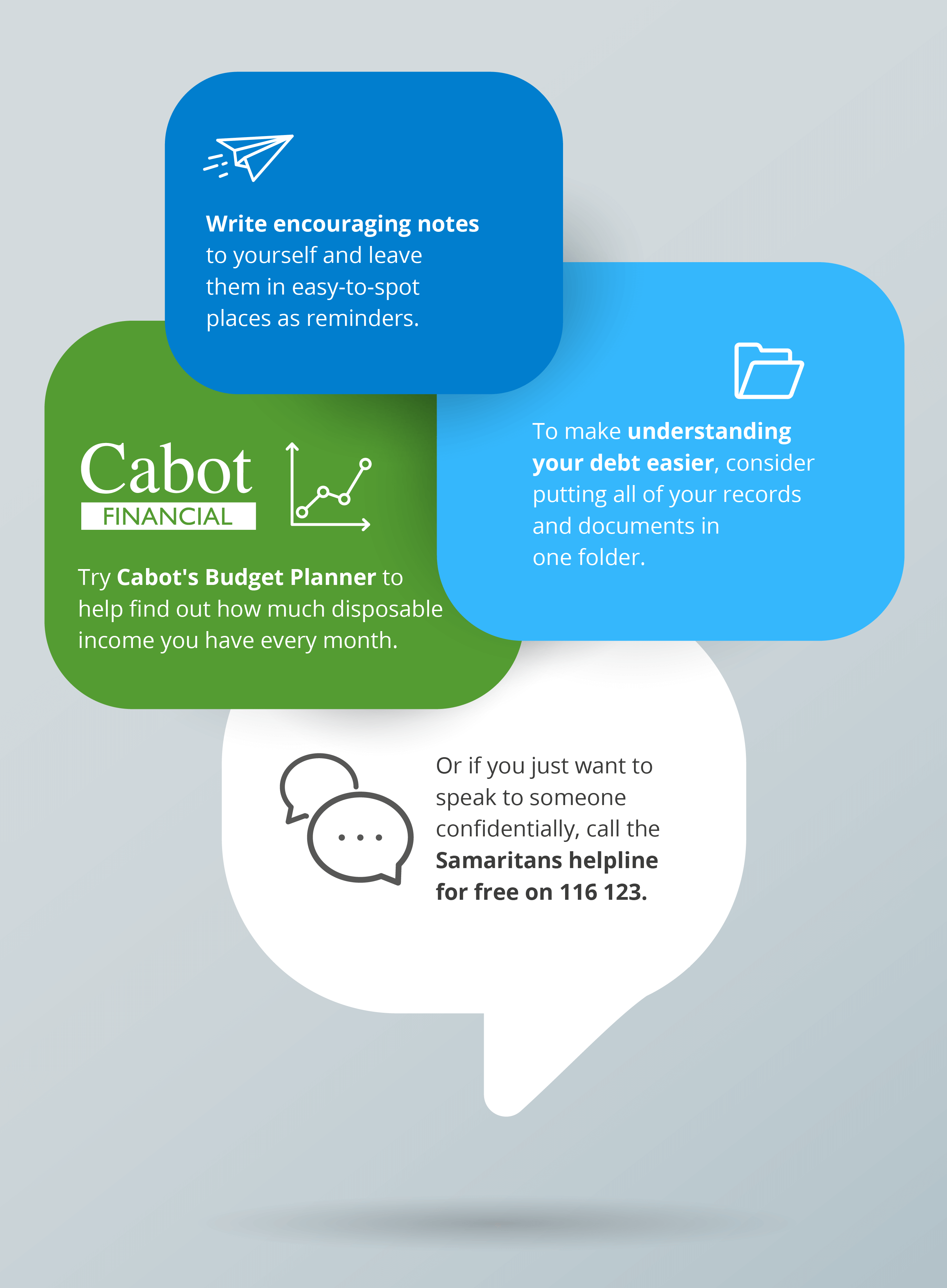

Cabot tip: To make it easier, consider putting all of your records and documents in one folder so they are easier to find.

If you struggle to know how much disposable income you have (that’s the money left for spending and saving after all direct taxes and outgoings have been accounted for) try using Cabot's Budget Planner. It can give you more clarity on how much money you have each month, which can make it easier to plan your spending.

.

Get professional debt advice

It’s natural to want to bury your head in the sand, to hope that the debt will simply go away. But it’s always better to face the situation and get advice – even if you feel it is too late. Charities such as National Debtline can help provide factsheets and sample letters. If you feel able, speaking to a friend or relative about your options can help too.

When you visit your doctor or any other healthcare professional, you can ask them to complete a Debt and Mental Health Evidence Form, first launched by the Money Advice Liaison Group in 2008. This will detail your condition and can be provided to creditors, to help them fully understand your situation.

If you are overcome with money worries, please don't hesitate to speak to the confidential Samaritans helpline for free on 116 123.

Get in touch with us

If you're worried about talking to us, remember that we're here to help you to discover financial recovery plans that are right for you. We also will never ask you to pay more than you can afford.

Find out more about how flexible we can be, by getting in touch today. We can create a payment plan that will work best for you.