Watch the video to find out what to do next:

- We'll get in touch by phone, letter or email.

- Talk to us and we'll work with you to find a plan that's affordable for you.

- If at any point things become unmanageable, just get in touch - we want to help.

- Together we'll get your debt cleared and put you on the road to financial recovery.

Cabot will only contact you by phone after sending an introductory letter to your address. When contacting you, we will ask you security questions in line with data protection requirements.

We will never discuss personal or account information, or ask for a payment, prior to completing security questions. Please ensure that you complete security questions before revealing any personal details.

If you are a Cabot customer and are unsure if it is Cabot who has contacted you, please call us on 0344 556 0263* so we can assist you.

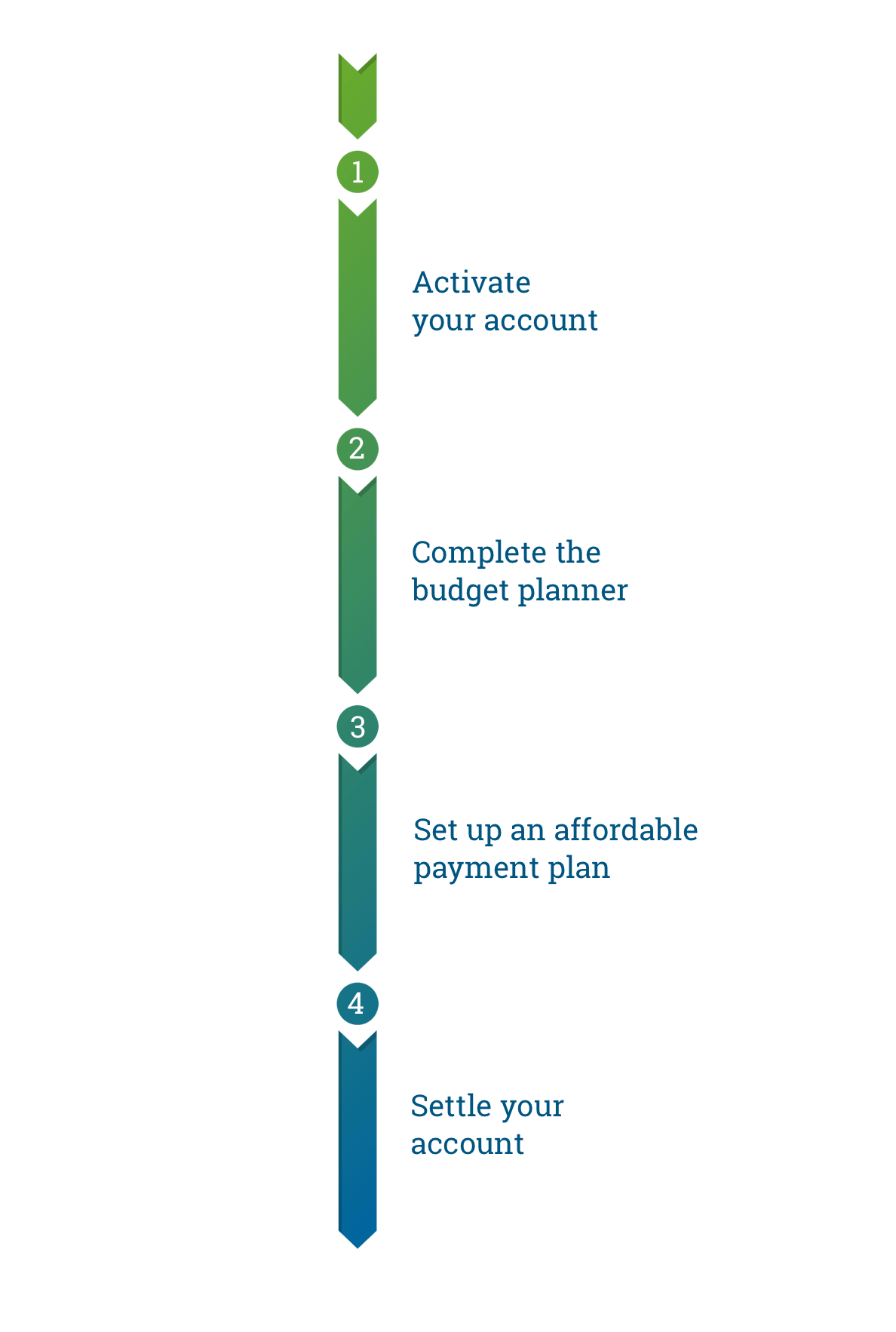

4 steps to financial recovery

You'll be able to set specific goals that help you on the journey to financial recovery. These goals might include:

.

Getting in touch

Call us on:

0344 556 0263*

Our phone lines are open:

Monday - Friday 8:00am - 8:00pm

Saturday 9.00am - 1.30pm

Sunday Closed

*Calls to our 03 numbers will be charged at local rate from landlines and mobiles.

What makes us different?

Just talk to them and see what they can do for you. They're not going to expect you to pay it back all at once, they've probably dealt with thousands of customers who are in the same situation as you are. They're there to help you and they only ask you to pay back what you can.

Read more of Emma's story here:

What managing your account means to you

You'll be able to set specific goals that help you on your journey to financial recovery. These goals might include:

- Improving your credit rating in order to obtain credit at a more competitive rate

- Getting your finances in order

- Improving your credit rating in order to get a mortgage and buy a home

- Being financially stable in order to move jobs or even start a business

Our goal

"Helping each and every customer to financial recovery."

It’s the focal point of everything we do. Our unique approach to credit management makes us different to other debt purchase companies. We’re friendly, flexible and always strive to understand our customers’ situation in depth before we begin to discuss repayment.

As our many satisfied customers will tell you, we know that everyone’s situation is different and we treat people as individuals. We offer a range of credit management solutions for every customer so they can repay what they owe, but not have to put their lives on hold while doing so.

Our history

Established in 1998, Cabot Financial is one of the most respected debt purchase companies in the UK. We have offices all across the UK in addition to our headquarters in Kings Hill, Kent. We help over 2 million customers manage their credit commitments.

We are part of the Cabot Credit Management Group, who are authorised by the Financial Conduct Authority, and are members of the Credit Services Association. We operate to the highest regulatory standards and take pride in the way we engage with our customers.

The interests of our customers and clients are at the heart of our business. We follow the Credit Services Association’s Code of Practice to ensure that the interests of our customers and clients remain at the heart of our business.

These codes and standards are supported by policies and controls that support fair outcomes for everyone involved.

Related articles

*Calls to our 03 numbers will be charged at local rate from landlines and mobiles