Who are Cabot Financial?

Established in 1998, Cabot Financial is one of the most respected debt purchase companies in the UK. We have offices all across the UK with our headquarters in Kings Hill, Kent. We help over 2 million customers manage their credit commitments.

We are part of the Cabot Credit Management Group, who are authorised and regulated by the Financial Conduct Authority, and are members of the Credit Services Association. We operate to the highest regulatory standards and take pride in the way we engage with our customers.

The interests of our customers and clients are at the heart of our business. We follow the Credit Services Association’s Code of Practice to support good outcomes for everyone involved.

Who has purchased my debt?

Do Cabot Financial buy debts?

As a debt purchasing company, we purchase portfolios of debt from credit providers, including banking, consumer finance, telecommunications companies, retailers, utilities companies and government agencies. The portfolios we purchase are made up of individual debts such as credit/debit cards, loans, hire purchase and many more. These debts aren't purchased on an individual basis, but as a collective. This means we cannot purchase a debt that a customer may have with another company.

All debts purchased by Cabot Credit Management Group Limited (CCM Group) are owned by purchasing companies within the CCM Group. These purchasing companies use the CCM Group to recover debts on their behalf.

In turn, the CCM Group appoints representatives, and companies both within and external to the Group to recover and/or administer a debt on its behalf. You will always be notified of the name of the organisations involved.

CCM Group is authorised and regulated by the Financial Conduct Authority (FCA), and with the FCA’s permission, appoint representatives and operational companies to recover and/or administer debts on their behalf.

Operational companies are permitted to carry out debt recovery and/or administration activities as a result of the CCM Group being authorised to appoint them as representatives by the FCA.

The operational company, which is an appointed representative of the CCM Group, is Cabot Financial (Europe) Limited.

Purchasing companies are exempt from being authorised by the FCA as they only own the debt, engaging CCM Group to recover and/or administer the debts on their behalf.

The UK purchasing companies in the CCM Group are Cabot Financial (UK) Limited, Marlin Capital Europe Limited, MCE Portfolio Limited, MFS Portfolio Limited, Marlin Europe I Limited, Marlin Europe II Limited, ME III Limited, ME IV Limited, Marlin Europe V Limited, Marlin Europe VI Limited, and Cabot Financial Portfolios Limited.

How long before a debt is written off

A common misconception is that debt will disappear after 6 years once it has fallen off your credit file. In fact, unpaid debt never really disappears, the balance will remain outstanding.

A debt isn't written off unless a creditor agrees you no longer have to make payments to the account and they will not pursue you for the outstanding balance.

If an account is on your credit file, and your creditor has agreed to write off your debt, your entry will be reflected as a 'partial settlement' with a 'nil' balance. This shows that your account has been settled and the balance is no longer outstanding.

If you would like your credit file entry updated to 'fully satisfied', you'll need to repay your balance in full. You can do this by making a one off payment for the full balance, or spreading the cost with affordable instalments.

If you have an account that isn't showing on your credit file, that doesn't mean that your debt is written off. Your balance will still remain outstanding and your creditor can still pursue you for the balance owed.

Why did I receive a Cabot Financial letter?

If you've received a letter from us, then we have recently purchased your account and you've become a customer of Cabot. This means we'll be responsible for helping you manage your account.

You may not realise just how many options you have to manage your credit commitments. Our team of Customer Consultants are here to listen to you and understand your situation.

Together, we can put together a plan of action for your future. Get in touch today to start your journey to financial recovery:

I have some money but not enough to clear the balance. Can I make an offer?

If you have amassed a sum of money that falls short of your balance, but you would like to see whether you can make a settlement offer, read on...

Making a settlement offer, even if it’s not for the full sum owed, is possible. You have two options:

- Make an offer for repayment - Sign in and visit the 'make a settlement offer' page. You can find this page under 'Payment Options' in your sidebar menu when you click on 'My Account'. If you do not have an online account, you will need to register first. Aside from learning more about making a settlement offer, there are many reasons why it could be in your best interest to register for an online account with Cabot - discover them here.

- Talk to one of our Customer Consultants who are always on hand to help with your queries. If you are unsure whether to contact Cabot or not, you can learn more about the benefits of keeping up communication with us. If your account qualifies, the Customer Consultant will be able to apply a discount.

In both instances, please note, this may be recorded as a ‘partial settlement’ on your credit record and may make it harder for you to get credit in the future. Your credit score is integral to successful money management and there are a number of ways you can improve your rating.

What is a partial settlement?

A partial settlement is an agreement on the repayment of debt

Partially settling your account is an agreement between you and the creditor to settle the account for less than the total owed. This can take place by either choosing to accept a discounted settlement arrangement or by submitting an offer of repayment. By settling your account, you will no longer receive communication from your creditor to peruse the remainder of the balance.

Once the account has been settled you will no longer be pursed for money owed, but this doesn’t prevent the fact that the debt was not fully repaid. Your credit file will be updated to show the account was ‘partially settled’, which will indicate to other creditors that the account was closed but with a lesser amount paid than the balance owed.

You may choose to pay the remainder of your balance to ‘satisfy’ the account at a later date, and your credit file will be updated to show that the debt has been paid in full. You can do this by contacting the creditor directly and requesting a full settlement.

What is a Payment Plan and how to set one up?

A payment plan is a commitment between us that you’ll pay a certain amount back over an agreed amount of time to clear your account. It allows you to pay off your balance in a way that's manageable and affordable. When setting up a Payment Plan, you will be offered the option to make a Kickstart Payment. A Kickstart Payment is a one-off payment made on the creation of your plan to help you clear your balance faster. Read more about Kickstart Payments here.

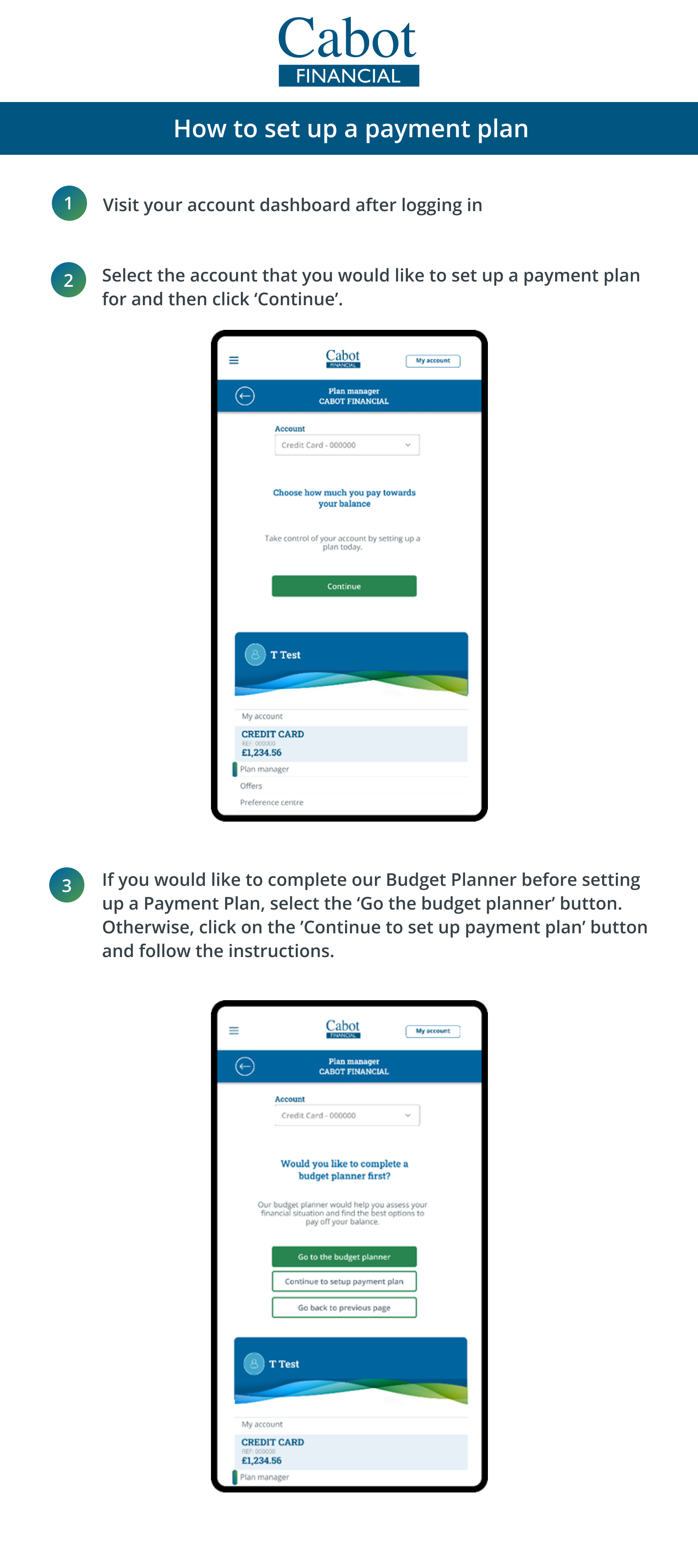

Here's an infographic to help you set up your payment plan:

.

If you'd like to assess what you can afford first, click 'Help me make a plan'.

If you need any help with setting up your plan, talk to us on live chat,* our Customer Consultants can guide you through step by step.

*Our live chat is available Monday - Friday 8am-8pm, Saturday 9am-1.30pm

How to pay off a County Court Judgment?

If you’re issued with a County Court Judgment (CCJ), it’s important to pay off the judgment debt. Otherwise, you could end up facing more legal costs and other forms of enforcement activity. Here’s what you need to know.

You receive a County Court Judgment (CCJ) when a court decides that you owe a creditor money. You’ll get a court order explaining how much you owe, who you owe it to, and the deadline for paying it.

You’ll either have to pay off the whole amount at once, or in instalments.

If you can, it’s best to try and pay all of what you owe as soon as possible. If you can clear the debt within one calendar month, you can avoid having the CCJ registered on your credit file.

What’s the best way to pay?

You need to pay the business or person you owe money to, or their solicitor. Don’t accidentally pay the courts.

It’s always useful to have proof of payment, so the best option is a bank transfer. Otherwise you can post a cheque.

What if I’m paying in instalments?

If you’re making lots of payments over time, ask your creditor about the best way to pay. It might be easiest to set up a Direct Debit or standing order if you can.

What if I can’t afford to pay?

It’s really important to stick to the amounts and deadlines set out in your CCJ. Otherwise you could be taken back to court, which will cost you more money.

If you genuinely can’t afford the repayments set out by the court, you can ask your creditor to change the amount you pay each week or month. Alternatively, you can fill in an N245 application form and submit it to the court. You may have to pay a £50 court fee for this.

You can also seek free debt management advice from organisations like PayPlan, StepChange, National Debt Helpline and Citizens Advice.

What if I just don’t pay?

If you fail to pay on time, your creditor can ask the courts to enforce the CCJ. They will have to pay a fee to do this, which will be added to what you owe.

The creditor has several options available:

1. Issue a Warrant of Control (Using a court bailiff)

A creditor can apply to the court for a bailiff to collect the debt. If the court agrees, it will issue a ‘warrant of control’, and bailiffs can come to your home to collect the money or seize goods to be sold to pay off your debt.

You’ll be given seven days’ notice of the date of the visit to give you time to contact your creditor to arrange payment. You may be able to prevent them from coming by filling in an N245 application form setting out how you plan to repay what you owe.

If your offer is accepted, the warrant will be suspended. If you miss future payments the creditor can request that the warrant is reissued.

2. An attachment of earnings order

This is when the money you owe is deducted from your wages by your employer and paid directly to your creditor.

The court will send you documents that you must respond to.

If this is likely to leave you unable to pay your bills, contact a debt adviser such as PayPlan or StepChange for help.

3. A charging order

If you own a property, your creditor can ask for a charging order to be secured against it. This means that when you sell your home, your creditor will be entitled to seek payment from the proceeds of the sale.

If a debt is secured against your property, your creditor can still ask you to make payments toward the debt

Make sure you get help from a debt adviser.

What if I have other debts?

If you have other judgments or debts, you can seek free debt management advice. These organisations may be able to assist you with setting up affordable payment arrangements with your creditors and provide you with information on the options available to you.

You can browse through our frequently asked questions on our help and support page, where you can use the search toolbar to answer any queries you may have.

If you haven't been able to find an answer on our help and support page, please get in touch with us.

Can't find what you're looking for? Have a look through our help and support page for more FAQs: